FEMA encourages everyone to get flood insurance, even if you don’t live in a high-risk flood zone. While governments are doing all they can to alleviate the impact of floods, everyone should play a role in protecting themselves.

To learn more about flood insurance, visit the FEMA National Flood Insurance Program site.

Doesn't my homeowners insurance policy cover flooding?

No. Flood damage is not covered by your homeowners insurance policy. In order for your home to be protected in the event of a flood, you will need to purchase a separate flood insurance policy.

If my home is flooded, won't federal disaster assistance pay for my damages?

No. Federal disaster assistance offers loans to help cover flood damage, not compensation for your losses. Even then, those loans are only available if the President formally declares a disaster. Fewer than 10 percent of all weather emergencies in the United States are declared disasters.

Am I eligible for flood insurance?

You must live in a community that participates in the National Flood Insurance Program (NFIP) to qualify for National Flood Insurance. The communities in Bexar County are all participating in the National Flood Insurance Program (NFIP).

I live in a low-risk flood zone. Do I really need flood insurance?

It’s a good idea to buy flood insurance even if you live in a low- or moderate-risk area. Almost 25 percent of all flood insurance claims come from areas with minimal flood risk.

Why does my mortgage lender require me to buy flood insurance?

The purchase of flood insurance is mandatory to qualify for Federal or federally-backed financial assistance for the acquisition and/or construction of buildings in high-risk flood areas (Special Flood Hazard Areas). If the property is not in a high-risk area, but instead in a low- to moderate-risk area, the law does not require flood insurance; however, it is recommended since historically about one-in-four flood claims come from these low- to moderate-risk areas. Note that if during the life of the loan the maps are revised and the property is now in the high-risk area, your lender will notify you that you must purchase flood insurance. If you do not purchase flood insurance, the lender will purchase a policy on your behalf, which could be at a much higher rate.

What if I want to purchase more insurance than the NFIP offers?

Many private insurance companies offer Excess Flood Protection, which provides higher limits of coverage than the NFIP, in the event of catastrophic loss by flooding. The maximum coverage the NFIP offers is $250,000 for dwelling coverage, and $100,000 for contents coverage.

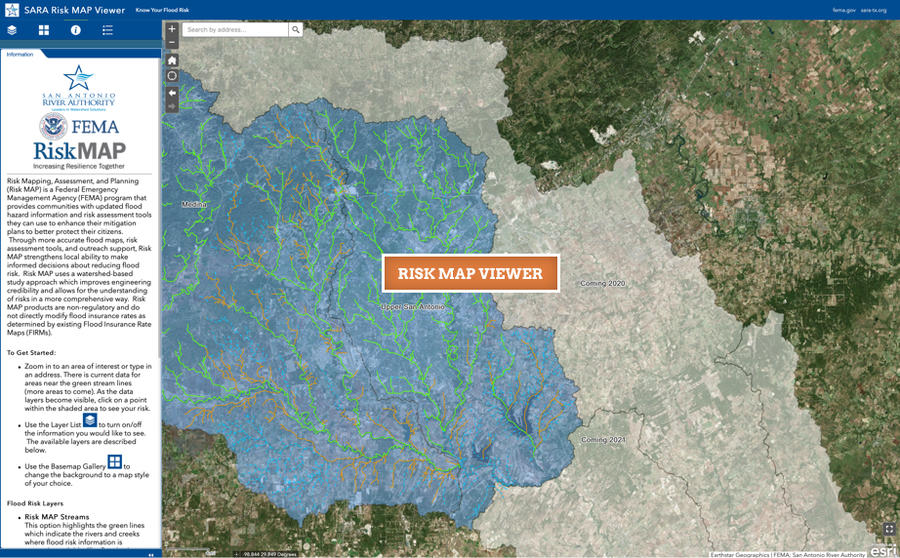

How do I found out what flood zone my home is in?

You can contact your insurance agent to provide you with a flood determination. This will provide you with the flood zone your home is located in.